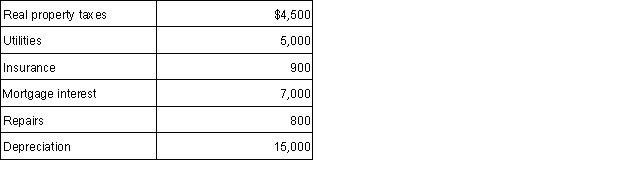

Elizabeth rented her personal residence for 12 days to summer vacationers for $4,800. Rest of the year, she and her family used the home as their personal residence. She has AGI of $105,000, excluding the rental income. Related expenses for Elizabeth's personal residence for the year include the following:  What is Elizabeth's AGI after taking into consideration the rental income and related expenses for her home?

What is Elizabeth's AGI after taking into consideration the rental income and related expenses for her home?

A) $4,800.

B) $100,200.

C) $105,000.

D) $109,800.

Correct Answer:

Verified

Q81: Lori and Donald own a condominium in

Q83: Royalties can be earned from allowing others

Q85: Royalties can be earned from allowing others

Q87: Which of the following statements is true

Q92: Royalties can NOT be earned from which

Q96: Richard owns a cabin in Utah that

Q101: What is meant by ordinary rental expenses

Q106: What must the owner of rental property

Q111: When reporting the income and expenses of

Q115: What are the criteria that determine an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents