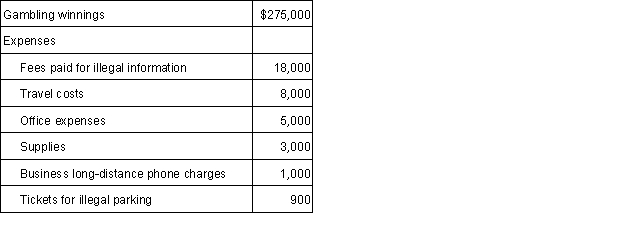

Patricia, a professional gambler, had the following income and expenses in her business:  How much net income must Patricia report from this business?

How much net income must Patricia report from this business?

A) $0.

B) $239,100.

C) $240,000.

D) $258,000.

Correct Answer:

Verified

Q21: For a cash-basis taxpayer,any account receivable that

Q27: On July 15, 2013, Travis purchased some

Q29: On May 26, 2011, Jamal purchased machinery

Q29: If inventory is a material amount,what method

Q30: On November 30, 2015, Constance purchased an

Q30: Which expenses incurred in a trade or

Q31: Education expenses are deductible if the education

Q33: If an activity is characterized as a

Q36: In June 2015, Kelly purchased new equipment

Q39: §179 expense is available for all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents