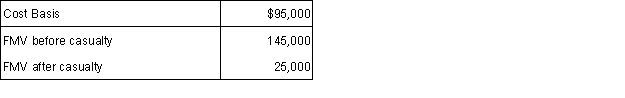

In 2015, the Chens' pleasure boat was severely damaged by a hurricane in an area that was declared a federal disaster area. They had AGI of $110,000 in 2015. The following information relates to the craft:  The Chens had insurance and received an $80,000 insurance settlement.

The Chens had insurance and received an $80,000 insurance settlement.

What is the allowable casualty loss deduction for the Chens in 2015?

A) $50,000.

B) $15,000.

C) $3,900.

D) $3,000.

Correct Answer:

Verified

Q53: Some charitable contributions are limited to 50%

Q55: Taxes deductible as an itemized deduction include

Q57: Which of the following organizations do not

Q58: In 2015, the U.S. President declared a

Q59: For investment interest expense in 2015, the

Q61: Which of the following organizations qualify for

Q63: During 2015, Carlos paid the following expenses:

Q65: In 2015, Maria who is 43, had

Q66: Which of the following miscellaneous itemized deductions

Q77: Which of the following miscellaneous deductions are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents