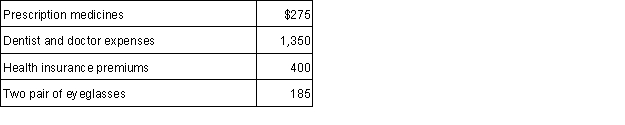

In 2015, Maria who is 43, had adjusted gross income of $27,000, paid the following medical expenses:  What amount can Maria deduct as medical expenses (after the adjusted gross income limitation) in calculating her itemized deductions for 2015?

What amount can Maria deduct as medical expenses (after the adjusted gross income limitation) in calculating her itemized deductions for 2015?

A) $2,710.

B) $2,025.

C) $685.

D) $0.

Correct Answer:

Verified

Q60: In 2015, the Chens' pleasure boat was

Q61: Which of the following organizations qualify for

Q63: During 2015, Carlos paid the following expenses:

Q66: Which of the following miscellaneous itemized deductions

Q67: Malika and Henry's vacation home was completely

Q68: Tyrell, who is 45, had adjusted gross

Q68: Which of the following expenses is deductible,but

Q69: The threshold amount for the deductibility of

Q77: Which of the following miscellaneous deductions are

Q79: Which of the following miscellaneous itemized deductions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents