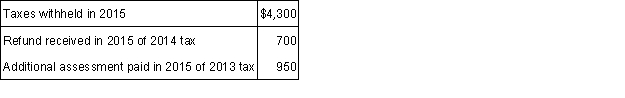

Gloria resides in a state that imposes a tax on income. The following information relates to Gloria's state income tax situation for 2015:  Assuming she elects to deduct state and local income taxes, what amount should Gloria use to calculate itemized deductions for her 2015 federal income tax return?

Assuming she elects to deduct state and local income taxes, what amount should Gloria use to calculate itemized deductions for her 2015 federal income tax return?

A) $0.

B) $3,600.

C) $5,250.

D) $5,950.

Correct Answer:

Verified

Q65: Which of the following is deductible as

Q76: Juan paid the following amounts of interest

Q77: Shanika lives in California which imposes a

Q78: Which of the following costs are potentially

Q79: The Frazins had adjusted gross income of

Q82: For 2015, the AGI threshold for the

Q84: Which of the following miscellaneous itemized deductions

Q86: For the year ended December 31, 2015,

Q97: What is the maximum amount of home

Q117: What is the proper treatment for prescription

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents