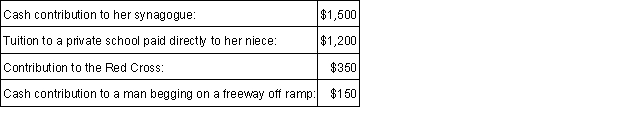

For 2015, Lydia had adjusted gross income of $40,000 and made the following charitable contributions:  What is the maximum amount that she can deduct as a charitable contribution for 2015?

What is the maximum amount that she can deduct as a charitable contribution for 2015?

A) $3,200.

B) $3,050.

C) $1,850.

D) $1,650.

Correct Answer:

Verified

Q84: Which of the deductions listed below is

Q94: During 2015, Manuel and Gloria incurred acquisition

Q96: Robert and Becky (husband and wife) are

Q97: Adrian, an NFL running back, is advised

Q99: Which of the following items would be

Q100: Which of the following types of taxes

Q105: If the donation is greater than $250,what

Q111: How does the declaration of a federally

Q115: What is usually the largest miscellaneous itemized

Q116: When are travel costs deductible as medical

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents