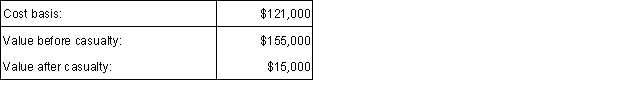

During the year, Megan's personal summer home was almost completely destroyed by a fire started in a work room. She had adjusted gross income of $110,000 in 2015 and related data with respect to the summer home follows:  Megan was partially insured for the loss and in 2015 she received a $100,000 insurance settlement. What is Megan's allowable casualty loss deduction for 2015?

Megan was partially insured for the loss and in 2015 she received a $100,000 insurance settlement. What is Megan's allowable casualty loss deduction for 2015?

A) $9,900.

B) $20,900.

C) $35,900.

D) $55,000.

Correct Answer:

Verified

Q81: How is the medical expense deduction calculated?

Q84: Which of the following miscellaneous itemized deductions

Q86: For the year ended December 31, 2015,

Q90: Barbara and Michael (wife and husband) are

Q91: Donald and May (husband and wife) contributed

Q97: What is the maximum amount of home

Q99: Which of the following items would be

Q101: What are four major categories of deductible

Q101: Describe the concept of a 10% floor

Q117: What is the proper treatment for prescription

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents