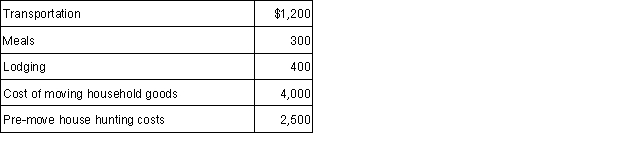

Due to a company consolidation, Rob transfers from Boston to San Diego. Under a new job description, he is reclassified from department manager to a staff member. His moving expenses, which are not reimbursed, are as follows:  Rob's deductible moving expense is:

Rob's deductible moving expense is:

A) $1,900.

B) $4,400.

C) $5,600.

D) $8,400.

Correct Answer:

Verified

Q80: In order to qualify for a Health

Q83: The for AGI deduction for the self-employment

Q84: For 2015, the maximum deductible and annual

Q87: What are the contribution amounts for both

Q87: Which of the following expenses does not

Q91: Under the terms of a divorce agreement,Bev

Q98: Which of the following is not deductible

Q99: What is the key limitation related to

Q105: Are any moving expenses deductible other than

Q112: What is a Health Savings Account (HSA)?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents