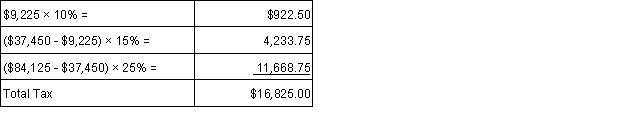

Tameka has taxable income of $84,125 that is taxed as follows:  Her marginal tax rate is:

Her marginal tax rate is:

A) 25%.

B) 20%.

C) 15%.

D) 10%.

Correct Answer:

Verified

Q83: Paid tax preparers must comply with all

Q84: Unemployment compensation income is reported to a

Q85: Which of the following refers to an

Q91: With respect to the income tax formula,

Q91: Which of the following courts has the

Q94: Sallie earned $85,000 and paid $5,950 of

Q96: Which of the following is not an

Q97: Which of the following statements is false

Q98: Sallie earned $25,000 and paid $2,000 of

Q115: Which of the following statements is true?

A)Compensation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents