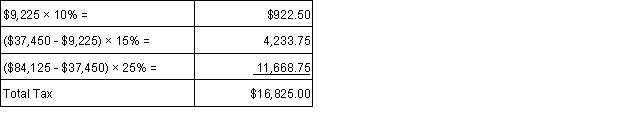

Tameka has taxable income of $84,125 that is taxed as follows:  Her average tax rate is:

Her average tax rate is:

A) 25%.

B) 20%.

C) 15%.

D) 10%.

Correct Answer:

Verified

Q81: A tax rate that remains the same

Q82: Taxpayers can file a Form 1040EZ if

Q84: On Form 1040EZ, the permitted deduction from

Q84: Unemployment compensation income is reported to a

Q86: Under the provisions of Circular 230,paid tax

Q89: Circular 230:

A)Establishes penalties for failure to comply

Q91: With respect to the income tax formula,

Q92: Which of the following would disqualify a

Q96: Which of the following is not an

Q97: Which of the following statements is false

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents