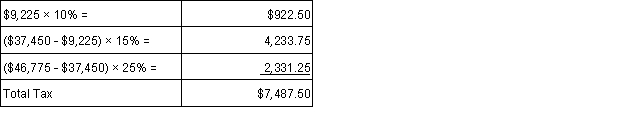

Xavier is single and has taxable income of $46,775 that is taxed as follows:  His average tax rate is:

His average tax rate is:

A) 10%.

B) 15%.

C) 16%.

D) 25%.

Correct Answer:

Verified

Q101: Which of the following courts hears only

Q104: With respect to the income tax formula,which

Q105: The tax liability for a married couple

Q106: Xavier is single and has taxable income

Q106: For equivalent amounts of taxable income,the total

Q108: Which of the following types of Regulations

Q108: Which of the following types of Regulations

Q109: Alice is an employee of Valley Company.Alice

Q112: On Form 1040EZ, the permitted deduction from

Q114: Victoria determined her tax liability was $6,451.Her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents