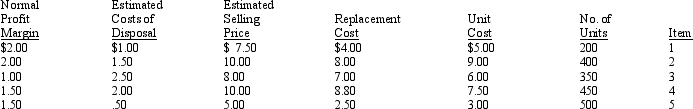

The Peter Park Company began operations in early 2013. At December 31, 2013, the company's ending inventory's cost was $12,950. The market value of the inventory at this date was $11,800. Peterson values its inventory at lower of cost or market applied on an individual item basis and uses a perpetual inventory system. Below is information relating to Peter's inventory at December 31, 2014:

Required:

a.Assuming that the company uses the allowance method, prepare the required entry at December 31, 2013, to record the inventory at lower of cost or market.

b.Prepare a schedule to calculate the inventory's value as of December 31, 2014, using the lower of cost or market method. The schedule should contain the following column headings: Item, Upper Constraint, Lower Constraint, Applicable Unit Inventory Value, Number of Units, and Total Inventory Value.

c.Prepare the required entry at December 31, 2014, to record the inventory at lower of cost or market. Assume the allowance method is used.

Correct Answer:

Verified

Q113: Given the following information for the Lawrence

Q114: After the auditors counted the inventory of

Q115: The Baby Super Store uses the average

Q116: Laura's Homemade cannot decide which inventory method

Q117: Below are a list of key terms.

Q119: The Smith Company uses the retail inventory

Q120: ......

Q121: .....

Q135: Ending inventory is over stated due to

Q139: Under special circumstances GAAP allows a company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents