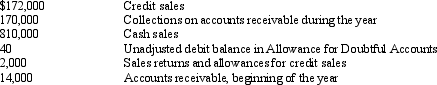

Based on the following information:

If bad debts are estimated to be 1 1/2% of ending accounts receivable, the adjusting entry to recognize bad debts will include a debit to Bad Debt Expense for

A) $170

B) $190

C) $210

D) $250

Correct Answer:

Verified

Q43: Which of the following is not a

Q47: If a company usually sells its accounts

Q49: A disadvantage of basing bad debt expense

Q60: The method for estimating bad debts that

Q65: Trainor Company estimates bad debt expense using

Q66: Which of the following is NOT a

Q67: Based on the following information:

Q69: A company records the transfer of accounts

Q72: Under the allowance method of recording bad

Q73: Splitter Corporation had total sales in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents