The following are transactions of the Morrison Company:

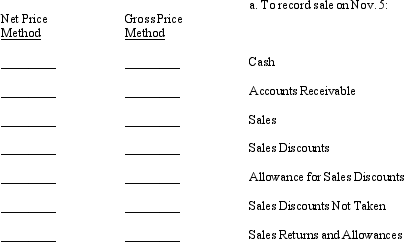

a.On November 5, sold merchandise on account for $46,000 with terms of 3/15, n/30.

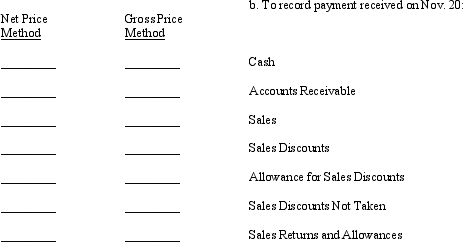

b.On November 20, payment was received on $32,000 worth of merchandise sold on November 5.

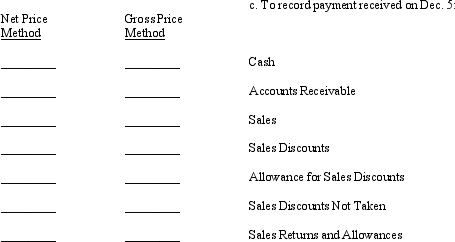

c.On December 5, further collections were made on $8,000 of merchandise sold on November 5.

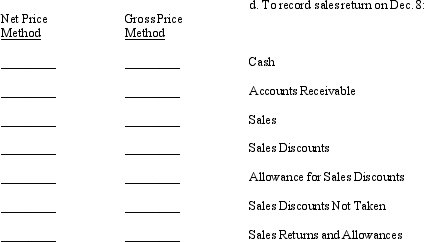

d.On December 8, merchandise sold for $4,000 on November 5 was returned by the purchaser and credit was granted by Morrison Company. Required:

Record the appropriate amounts under the gross price and net price methods in the spaces below. For each method, write the amount to be debited or credited on the appropriate line for each account shown. Indicate that the amount is a debit or credit by placing a (d) or (c) after the amount.

Correct Answer:

Verified

Q74: On a bank reconciliation, customers' checks that

Q80: When pledging accounts receivable

A)title to the receivables

Q98: When a company discounts a customer's note

Q99: O'Tole Co. reports assigned accounts receivable

Q100: Although IFRS contain the same basic guidelines

Q101: Companies should use petty cash funds to

A)

Q105: When completing the bank reconciliation, deposits in

Q105: On August 2 Banger Mash Company sold

Q106: Deposits made directly to the bank would

Q107: Which of the following is true concerning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents