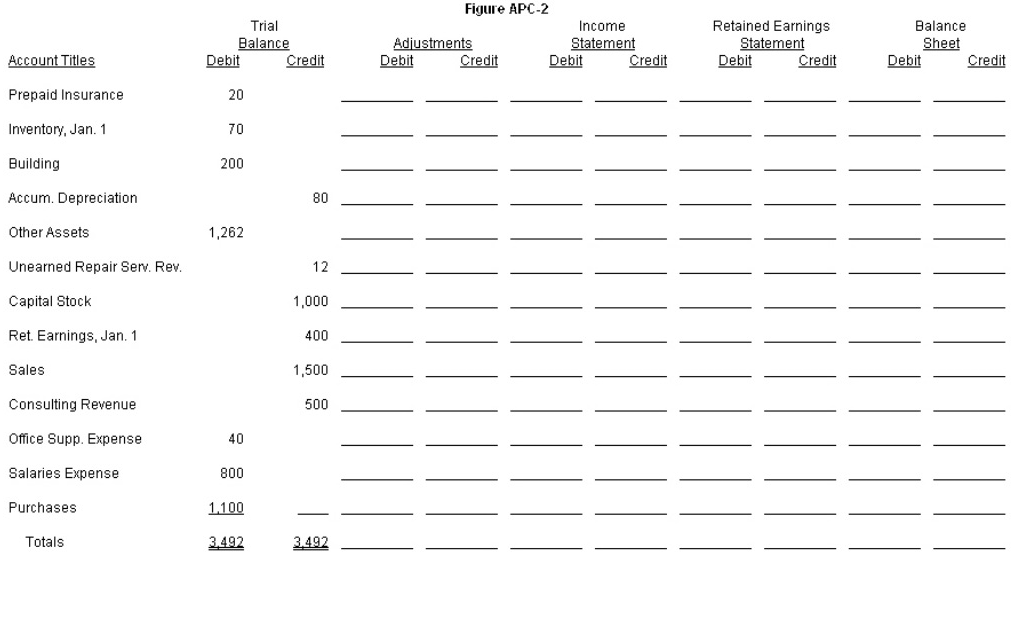

Figure APC-2 is the condensed worksheet for the Christopher Company as of December 31, 2014.

Additional Information:

Prepaid Insurance is for a two-year fire insurance policy dated July 1, 2014.

The ending inventory amounts to $76.

The building is being depreciated over a ten-year life, straight-line, no salvage value.

The balance in Unearned Repair Service Revenue pertains to a contract sold on November 1, 2014, to provide service to a client for one year.

Office supplies on hand at year-end amount to $14.

At year-end, there are accrued salaries of $6.

Consulting Revenue includes a contract for $60 received on October 1, 2014, for a one-year period of time.

The tax rate is 50%.

Required:

Complete the worksheet, assuming that adjusting entries are made only at December 31.

Correct Answer:

Verified

Calculations:

(a) $20/2 x 6/12 = $5 in...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: What is the primary purpose of a

Q132: Q133: Several accounts are listed below: Q134: The Bell Corporation uses a general journal, Q139: What are the advantages of using the Q139: Figure APC-1 is the condensed worksheet for Q140: The accrual and the cash bases of Q142: What is the purpose of the worksheet? Q143: What type of adjustments are necessary to Q144: What is the purpose of a reversing![]()

a.Cash

b.Retained Earnings

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents