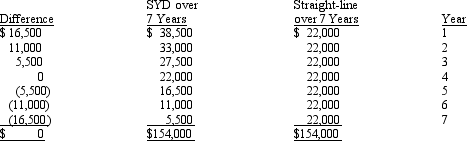

On January 1, Year 1, the Dole Company purchased an asset that cost $154,000. The asset had an expected useful life of seven years and no estimated residual value. The company initially decided to use sum-of-the-years'-digits (SYD) depreciation for both financial accounting and income tax purposes. Depreciation expense for the straight-line method and the sum-of-the-years'-digits method is as follows:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: Meagan Co. has the following errors on

Q109: On January 1, 2014, Dawn Company bought

Q110: Several errors are listed below.

Q110: When is a retrospective adjustment considered impractical

Q112: The Jessica Co. has the following errors

Q113: On January 1, 2014, Suzanne Company purchased

Q114: The Laura Company has the following errors

Q116: On January 1, 2014, Sarah Company purchased

Q117: Provide three examples of changes in principle.

Q118: What are the two methods for reporting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents