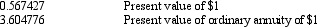

Exhibit 20-2 On January 1, 2014, Mary Company leased equipment, signing a five-year lease that requires annual lease payments of $20,000. The lease qualifies as a capital lease. The payments are made at year-end, and the first payment will be made at December 31, 2014. In addition, Mary guarantees the residual value to be $8,000 at the end of the lease term. Mary correctly uses the lessor's implicit interest rate, which is 12%. The present value factors for five periods at 12% are as follows:

-Refer to Exhibit 20-2. What is the correct interest expense for the year ending December 31, 2015, for the lease obligation? (Round answers to the nearest dollar.)

A) $20,000

B) $10,804

C) $ 7,900

D) $ 7,290

Correct Answer:

Verified

Q27: A capital lease should be recorded in

Q42: If a lessee classifies a lease as

Q44: When a lessee makes periodic cash payments

Q45: Exhibit 20-1 On January 1, 2014, Pearson

Q47: On January 1, 2014, Watson Company signed

Q48: Exhibit 20-2 On January 1, 2014, Mary

Q49: Exhibit 20-2 On January 1, 2014, Mary

Q50: On January 1, 2014, Madison Company signed

Q51: On January 1, 2014, Becky Company signed

Q60: Which of the following items would not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents