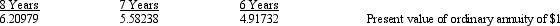

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:

What is the annual lease payment to be collected by Davis?

A) $ 8,571.43

B) $ 9,115.25

C) $10,139.72

D) $11,516.78

Correct Answer:

Verified

Q31: When a lessee makes periodic cash payments

Q45: Which of the following statements regarding the

Q59: On January 1, 2014, Reynolda Co. leased

Q62: Jennifer, Inc. entered into a five-year capital

Q64: On January 1, 2014, Stacie signed a

Q66: On January 1, 2014, Luke, Inc. leased

Q67: The Roger Company leased a machine at

Q67: Which of the following facts would require

Q68: For a sales-type lease, cost of asset

Q76: Depreciation expense will be recorded in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents