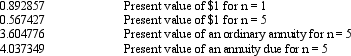

Exhibit 20-4 On January 1, 2014, Average Leasing Company entered into a direct financing lease with a lessee, Lenny Company. The lease agreement calls for five equal annual payments of $75,000 at the beginning of each year with the first payment due on January 1, 2014. The leased property has an estimated residual value of $10,000, which Lenny does not guarantee. The property remains the property of Average at the end of the lease term. Average desires a 12% rate of return. Present value factors for a 12% interest rate are as follows:

-Refer to Exhibit 20-4. The cost of the leased property to Average is (round the answer to the nearest dollar)

A) $308,475

B) $302,801

C) $276,032

D) $270,358

Correct Answer:

Verified

Q46: The lessee should report capital lease obligations

Q51: Which of the following is not a

Q75: A lessor enters into a sales-type lease.Which

Q76: On January 1, 2014, Stacie signed a

Q77: The lessee's disclosures should include the future

Q79: When a lessor receives cash on an

Q83: Exhibit 20-5 The Baltimore, Inc. entered into

Q83: Any initial direct costs incurred by the

Q85: Depreciation expense will be recorded in the

Q96: When a lessor receives cash on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents