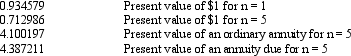

Exhibit 20-5 The Baltimore, Inc. entered into a five-year lease with the Waugh Chapel Company on January 1, 2014. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2014. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2018. The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7% interest rate are as follows:

-Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, how much gross profit will Baltimore record at the inception of the lease?

A) $ 7,505

B) $14,680

C) $16,061

D) $23,236

Correct Answer:

Verified

Q66: One of the distinguishing characteristics of a

Q93: A six-year operating lease requires annual rent

Q94: Exhibit 20-3 On January 1, 2014, Quinn

Q95: Exhibit 20-4 On January 1, 2014, Average

Q97: Exhibit 20-3 On January 1, 2014, Quinn

Q98: Which of the following items should be

Q101: Addison Company signs a lease agreement dated

Q102: Which of the following criteria would require

Q103: (This problem requires use of present value

Q104: On January 1, 2014, New Port News

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents