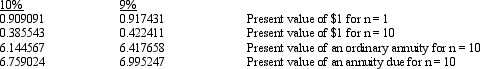

On January 1, 2014, New Port News Company leased equipment from Scanner Company. The lease had a non-cancelable ten-year term and required annual lease payments of $19,000 to be paid on January 1 of each year with the first payment due January 1, 2014. The annual payment includes $1,000 for executory costs. New Port News guarantees a $15,000 residual value at the end of the lease term. The estimated economic life of the equipment is 12 years. The fair value of the equipment on January 1, 2014 is $140,000. New Port News's incremental borrowing rate is 10%, and Scanner's implicit interest rate is 9%, which is known by New Port News. Present value factors for interest rates of 9% and 10% are as follows:

New Port News uses straight-line depreciation for its plant assets.

Required:

a.Compute the present value of the minimum lease payments. (Show computations and round all amounts to the nearest dollar.)

b.Classify the lease from the standpoint of the lessee, stating the reason for the classification.

c.Prepare each of the following journal entries on the lessee's books. (Show computations and round all amounts to the nearest dollar.)

(1)Record the lease agreement on January 1, 2014.

(2)Record the payment on January 1, 2014.

(3)Record any adjusting entries on December 31, 2014, in connection with the lease agreement.

Correct Answer:

Verified

Q89: If a lessor has an account, Equipment

Q93: A six-year operating lease requires annual rent

Q99: Exhibit 20-5 The Baltimore, Inc. entered into

Q100: The account Unearned Interest: Leases should be

Q101: Addison Company signs a lease agreement dated

Q101: Which statement is not true?

A)If a lease

Q102: Which of the following criteria would require

Q103: (This problem requires use of present value

Q107: (This problem requires use of present value

Q108: Which of the following is a required

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents