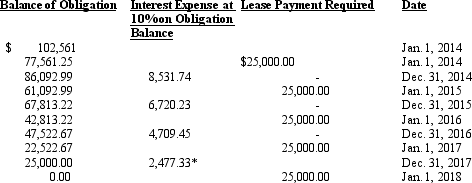

Addison Company signs a lease agreement dated January 1, 2014 for equipment from Luke Rental Company beginning January 1, 2014. The following information relates to the capital lease:

1) The lease term is 5 years, the lease is noncancelable and requires annual payments of $25,000 to be paid in the beginning of each year.

2) The cost and fair value of the equipment is $102,561. The equipment has an estimated life of 5 years and zero residual value.

3) Addison agrees to pay all executory costs.

4) There is no renewal or bargain options

5) Luke's interest rate is implicit to the lease at 11%. Addison is aware of this rate, which is equal to its borrowing rate.

6) Addison uses the straight line method to record depreciation.

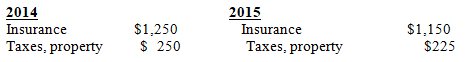

7) Executory costs paid at the end of year by Addison are:

*rounded

Required:

Prepare the journal entries for Addison for the years 2014 and 2015.

Correct Answer:

Verified

Q66: One of the distinguishing characteristics of a

Q93: A six-year operating lease requires annual rent

Q97: Exhibit 20-3 On January 1, 2014, Quinn

Q98: Which of the following items should be

Q99: Exhibit 20-5 The Baltimore, Inc. entered into

Q100: The account Unearned Interest: Leases should be

Q101: Which statement is not true?

A)If a lease

Q102: Which of the following criteria would require

Q103: (This problem requires use of present value

Q104: On January 1, 2014, New Port News

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents