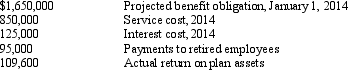

The Maggie Company has a defined benefit pension plan for its employees. The following information pertains to the pension plan as of December 31, 2014:

The amount of the December 31, 2014, projected benefit obligation is

A) $2,515,400

B) $2,270,400

C) $2,530,000

D) $2,420,400

Correct Answer:

Verified

Q19: Accounting for prior service cost prospectively would

Q19: Accounting regulators opted to recognize the liability

Q20: Which of the following statements is true

Q26: Amortization of any net gain or loss

Q28: Which statement is false?

A) In the computation

Q28: The Lucas Company offers employees a defined

Q31: In the computation of pension expense, interest

Q38: Which of the following is not a

Q40: A company's pension expense includes all of

Q47: Accounting principles for defined benefit pension plans

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents