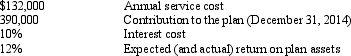

John Company adopted a defined benefit pension plan on January 1, 2014, and prior service credit was granted to employees. The present value of that prior service obligation as of January 1, 2014 was $1,400,000 and is being amortized by the straight-line method over the remaining 20-year service life of the company's active employees. Additional information relating to the company's pension plan for 2014 is presented below:

What amount should be recorded in Prepaid/Accrued Pension Cost when recording the 2014 pension expense and funding at December 31, 2014?

A) $ 1,200

B) $48,000

C) $87,000

D) $94,800

Correct Answer:

Verified

Q41: Vested benefits are

A)estimated benefits

B)not contingent on future

Q46: If a company uses the indirect method

Q55: ACE has a defined benefit pension plan.

Q57: Exhibit 19-02 The Sophia Company adopted a

Q59: Which of the following statements regarding postretirement

Q61: Attribution period starts on the

A) hiring date

B)

Q62: The attribution period ends at

A) the expected

Q63: During 2013, the Electric Company experienced a

Q64: In 2014, the Electrician Company decided to

Q65: The following information is related to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents