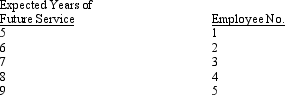

Martha Co. has a defined benefit pension plan for its employees. The plan was amended at the beginning of 2014 which increased benefits based on services rendered by certain employees in prior periods. The actuary has reported that unrecognized prior service cost resulting from the amendment is $385,000. Five employees expect to receive the increased benefits. Shown below is a schedule of the employees and their expected years of future service:

Required:

Using the straight-line method:

a.Compute the average remaining service life.

b.Determine the amount of unrecognized prior service cost to be included in the 2014 pension expense calculation.

Correct Answer:

Verified

Q63: In addition to providing pensions to their

Q64: Current GAAP requires that a company with

Q65: One type of post-retirement benefit other than

Q72: Postemployment benefits are provided to former employees

A)

Q76: A list of terms (a-i) and a

Q77: Mark, Inc. amended its defined benefit pension

Q78: Robin Co. has a defined benefit pension

Q79: Karen Company began a defined benefit pension

Q84: What five alternatives were examined by regulators

Q91: What disclosures are required by GAAP about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents