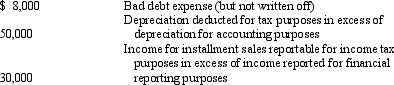

For the year ended December 31, 2014, the Bowling Green Company reported income of $350,000 before provision for income tax. In arriving at taxable income for income tax purposes, the following differences were identified:

Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2014, is

A) $ 83,400

B) $101,400

C) $113,400

D) $129,000

E) none of these

Correct Answer:

Verified

Q5: Which of the following transactions would typically

Q12: Under IFRS ,valuation allowances for deferred tax

Q16: When congress makes a tax law or

Q17: Deductions that are allowed for income tax

Q17: The amount owed the IRS is recorded

Q19: A corporation must recognize a valuation allowance,

Q20: Permanent differences arise due to timing differences

Q24: In 2014, Waterford Corporation reported pretax financial

Q26: Bourne Company received rent in advance of

Q36: Interperiod tax allocation is required for all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents