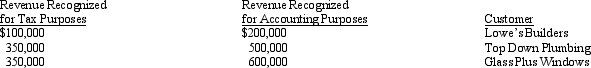

Lewes Company appropriately uses the installment sales method for tax purposes and the accrual method for revenue recognition for accounting purposes. Pertinent data at December 31, 2014, the close of the first year of operations, are as follows:

Lewes's tax rate is 30%. What amount should be included in the deferred tax account at December 31, 2014 for these installment sales?

A) $150,000 deferred tax asset

B) $150,000 deferred tax liability

C) $500,000 deferred tax asset

D) $500,000 deferred tax liability

Correct Answer:

Verified

Q26: Life insurance proceeds payable to a corporation

Q29: Permanent differences impact

A)current deferred taxes

B)current tax liabilities

C)deferred

Q38: In 2014, its first year of operations,

Q39: Exhibit 18-1 On December 31, 2013, Fredericksburg,

Q40: A deferred tax asset would result if

A)

Q42: The Pink Diamonds Company installs fire alarm

Q46: At the end of its first

Q47: The Flintstone Company incurred the following expenses

Q48: During its first year of operations ending

Q50: Which one of the following requires interperiod

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents