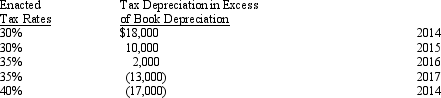

In 2014, its first year of operations, Richmond Corporation reported pretax financial income of $80,000 for the year ended December 31. Richmond depreciates its fixed assets using an accelerated cost recovery method for tax purposes and straight-line depreciation for financial reporting. On assets acquired in 2014, the following are differences between depreciation on the tax return and accounting income during the asset's five-year life:

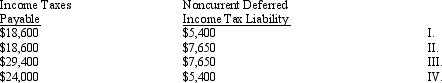

Assuming no other temporary or permanent differences, Richmond's December 31, 2014 balance sheet should include

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Q4: Interperiod income tax allocation is based on

Q13: Which of the following would not result

Q16: Permanent differences between pretax financial income and

Q19: In accounting for income taxes, percentage depletion

Q42: Revenue from installment sales is recognized in

Q52: When accounting for the current impact of

Q54: Shane Company uses an accelerated depreciation method

Q54: An operating loss carryforward occurs when

A)prior pretax

Q60: In 2014, the Puerto Rios Company received

Q61: Which of the following are required disclosures

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents