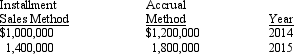

On January 1, 2014, Bedrock Company began recognizing revenues from all sales under the accrual method for financial reporting purposes and under the installment sales method for income tax purposes. Bedrock reported the following gross margin on sales for 2014 and 2015:

The enacted tax rate for both 2014 and 2015 was 30%. Assuming there are no other temporary differences, Bedrock's December 31, 2015 balance sheet would report a deferred tax liability of

A) $ 60,000

B) $120,000

C) $180,000

D) $450,000

Correct Answer:

Verified

Q13: Which of the following would not result

Q29: Permanent differences impact

A)current deferred taxes

B)current tax liabilities

C)deferred

Q46: At the end of its first

Q47: The Flintstone Company incurred the following expenses

Q48: During its first year of operations ending

Q50: Which one of the following requires interperiod

Q52: When accounting for the current impact of

Q53: Which one of the following statements regarding

Q54: An operating loss carryforward occurs when

A)prior pretax

Q54: Shane Company uses an accelerated depreciation method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents