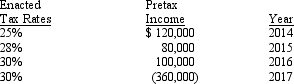

The Mishka Corporation reported the following income for both accounting and tax purposes:

Mishka Corporation uses the carryback provision for net operating losses when possible. The enacted tax rate for 2018 and future years is 32%. Mishka believes that sufficient verifiable positive evidence exists so that a valuation allowance is not necessary at the end of 2017.

Required:

Prepare the entries for income tax expense and related assets and liabilities for the Mishka Corporation for the years 2014 through 2017.

Correct Answer:

Verified

Q86: Differences arising between financial accounting and tax

Q87: Thorn Corporation has deductible and taxable temporary

Q88: The following information relates to the Kill

Q89: What conclusion did FASB come to in

Q92: Lakeland Corporation reported the following pretax (and

Q93: What two issues does FASB have to

Q94: At the beginning of 2014, Jasper Company

Q95: In order to implement FASB's objectives what

Q96: At the end of its first year

Q108: What are the three types of permanent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents