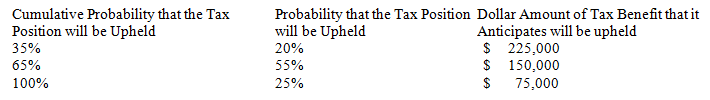

At the end of the current year, Brothers company claims a $225,000 tax credit on its income tax return. Brothers is uncertain about whether the IRS will accept the credit. After some research it is determined that the IRS may not accept all of the tax credit. Brothers estimates the likelihood using the following probability distribution:

Required:

For the current year determine:

1) the amount Brothers will be able to recognize as a current tax benefit

2) the amount that will be record as the unrecognized tax benefit.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: In order to implement FASB's objectives what

Q96: At the end of its first year

Q97: Rice, Inc. began operations on January 1,

Q98: What two objectives did FASB identify for

Q99: Rehobeth Company's taxable income and other financial

Q101: What should a corporation disclose for the

Q102: Identify the three essential characteristics of an

Q103: Discuss what criteria a company should employ

Q104: Discuss both interperiod and intraperiod tax allocation

Q107: What is intraperiod tax allocation?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents