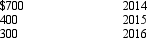

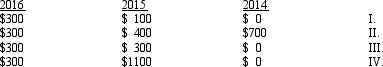

On January 1, 2014, Reids, Inc. sold a risky investment for $1,400 that had been purchased for $1,000. It was decided to use the cost recovery method of revenue recognition. Cash collections on accounts receivable related to the asset were as follows:  Which of the following represent the realized gross profit that Reids should recognize for each year?

Which of the following represent the realized gross profit that Reids should recognize for each year?

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Q44: If the consignment-in account has a credit

Q72: When there is a very high degree

Q73: A company may not use the installment

Q74: The cost recovery method

A) is generally not

Q75: If material, the gross profit from installment

Q78: Exhibit 17-5 Kusick Co. sold a

Q79: Exhibit 17-5 Kusick Co. sold a

Q80: Exhibit 17-4 The following information is provided

Q81: Jones sells computer software to Wyatt that

Q82: Bel Air, Inc. sold a franchise that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents