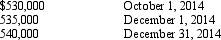

On October 1, 2014, White Company declared a property dividend payable in the form of marketable equity securities classified as "available for sale" for financial accounting purposes. The marketable equity securities will be distributed to the common stockholders on December 1, 2014. The investment in equity securities originally cost White $510,000 on August 1, 2014. The investment's fair value on various dates is as follows:

The amount credited to Gain on Disposal of Investments resulting from this dividend transaction should be

A) $ 0

B) $20,000

C) $25,000

D) $30,000

Correct Answer:

Verified

Q6: A board of directors may decide to

Q9: The Chester Company has issued 10%, nonparticipating,

Q10: A simple capital structure is one that

Q11: A retained earnings statement usually includes only

Q12: The Stansbury Company has issued 10%, partially

Q15: "Disclosure of changes in the separate accounts

Q17: On November 1, 2014, the Cranberry Construction

Q18: The denominator in the calculation for basic

Q42: All of the following types of dividends

Q50: Which statement best represents the relationship between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents