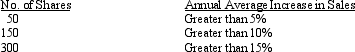

Exhibit 15-6 On January 1, 2014, 50 executives were given a performance-based share option plan that would award them with a maximum of 300 shares of $10 par common stock for $20 a share. On the grant date, the fair value of an option was $16.50. The number of options that will vest depends on the size of the annual average increase in sales over the next three years according to the following table:  On the grant date, the company estimates the annual average sales increase will be 14%.

On the grant date, the company estimates the annual average sales increase will be 14%.

-Refer to Exhibit 15-6. The estimated total compensation cost will be

A) $ 55,000

B) $123,750

C) $ 27,500

D) $247,500

Correct Answer:

Verified

Q58: Under the fair value method, the grant

Q63: Exhibit 15-3 On January 1, 2014,

Q64: Exhibit 15-5 On January 1, 2013, Roberts

Q65: Exhibit 15-4 On January 1, 2014, Masters,

Q66: Exhibit 15-5 On January 1, 2013,

Q69: Exhibit 15-5 On January 1, 2013, Roberts

Q70: On January 1, 2014, Watchtower Corporation granted

Q71: When accounting for a fixed compensatory share

Q73: Exhibit 15-4 On January 1, 2014, Masters,

Q77: Which of the following share option plans

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents