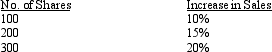

Exhibit 15-7 On January 1, 2013, 70 executives were granted a performance-based share option plan that would award them each a maximum of 300 shares of $5 par common stock for $12 a share based on the increase in sales over the next three years. The fair value per option on the grant date was $16. The award table is as follows:

The company estimates that the sales increase will be 22% and that the annual employee turnover rate will be 2%.

-Refer to Exhibit 15-7. In 2014 the actual sales increase was determined to be 18%, and the overall turnover rate was exactly 2%. The compensation expense for 2014 is (to the nearest dollar)

A) $210,828

B) $140,552

C) $ 70,276

D) $ 35,138

Correct Answer:

Verified

Q61: For a stock appreciation rights (SAR)compensation plan,

Q81: Which of the following is not a

Q90: When callable preferred stock is recalled, if

Q92: Wally, Inc. issued 500 shares of $10

Q93: Exhibit 15-8 On January 1, 2013, Margarita

Q97: Exhibit 15-8 On January 1, 2013, Margarita

Q99: For share appreciation rights SARs) compensation plans

Q100: The preference to dividends that preferred stockholders

Q100: Mars Corp. has 15,000 shares of $5

Q101: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents