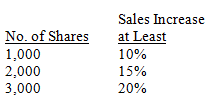

On January 1, 2013, Biggs Company granted a performance-based stock option plan to 40 executives to buy a maximum of 3,000 shares each of its $10 par common stock at $30 a share. The fair value per option is $8. The terms of the plan, which has a three-year service and vesting period, are based on the following scale:

Biggs expects an annual employee turnover rate of 3%, and the company initially anticipates an increase in sales during the service period of 18%. By the end of 2015, the actual sales increase is 17%.

a.Compute the estimated total compensation cost.

b.Compute the annual compensation expense for each of the three years.

c.Prepare the January 1, 2016, entry when 10 executives exercise their options.

Correct Answer:

Verified

Q128: Define the following terms:

Treasury Stock Authorized capital

Q131: On January 1, 2013 Howard Corporation issued

Q132: Consider each situation for Kathy, Inc. below

Q133: Several items appear below. Q134: Sully Sports Cars Co. entered into a Q135: A partial listing of accounts and ending Q137: Advance Medical Imaging, Inc. reacquired 2,000 shares Q138: On January 1, 2015, sixty executives are Q139: Given the following information for Jumping Johns Q140: On January 3, 2013, Maris Corporation issued![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents