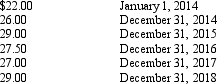

On January 1, 2014, the Jim Corporation granted 50,000 stock appreciation rights (SARs) to the company's president, Jim Darling. Jim will be entitled to receive cash or common stock or some combination of cash and common stock for the difference between the quoted market price at the date of exercise and a $20 option price per SAR. It is assumed that Jim will elect to receive cash when he exercises his SARs. The service period is three years, and he may exercise his SARs during the period January 1, 2017, through December 31, 2018. The market prices per share of Jim Corporation's common stock are as follows:

On December 31, 2018, Jim Darling exercises his 5,000 SARs and elects to receive cash.

Required:

a.Prepare the journal entries to record each year's compensation expense related to the SARs.

b.Prepare the December 31, 2018 entry to record the exercise of the 50,000 SARs.

Correct Answer:

Verified

Q118: When retiring treasury stock, retained earnings could

Q119: Righty, Inc., entered into a stock subscription

Q120: All of the following would appear in

Q121: The following information is provided from the

Q122: Trevor had outstanding 40,000 shares of $30

Q124: On January 1, 2015, Asquith Company adopts

Q125: Several years ago, Walther, Inc. issued 12,000

Q126: On January 1, 2013, Robertson Company created

Q127: .....

Q128: Below is the partial trial balance for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents