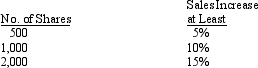

On January 1, 2014, Nelson Company gave 45 executives a performance-based stock option plan that allowed them to buy a maximum of 2,000 shares each of the company's $5 par common stock at $15 a share. On the grant date, the fair value per option was $8. The shares will be awarded based on the increase in sales over a four-year service and vesting period as follows:

The company estimates sales will increase by 8% during the service period and that the annual employee turnover rate will be 4%. During 2016, the estimated annual employee turnover rate was changed to 3% for the entire service period. At the end of the four-year period, options vested for the remaining 40 executives and sales actually increased by 12%.

Required:

Prepare the journal entries to reflect the events affecting Nelson's plan for the four-year service period.

Correct Answer:

Verified

Mem...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: Several years ago, Walther, Inc. issued 12,000

Q126: On January 1, 2013, Robertson Company created

Q127: .....

Q128: Below is the partial trial balance for

Q131: On January 1, 2013 Howard Corporation issued

Q132: Consider each situation for Kathy, Inc. below

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents