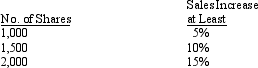

On January 1, 2015, Asquith Company adopts a performance-based stock option plan with a four-year vesting and service period, a $35 exercise price, and a $6 per option fair value. The plan grants a maximum of 2,000 shares of $5 par common stock to each of the company's 30 executives. The number of shares that vest depends on the increase in sales during the service period, based on the following scale:  Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2019.

Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2019.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan (2015 through 2019).

Correct Answer:

Verified

Mem...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: Righty, Inc., entered into a stock subscription

Q120: All of the following would appear in

Q121: The following information is provided from the

Q122: Trevor had outstanding 40,000 shares of $30

Q123: On January 1, 2014, the Jim Corporation

Q125: Several years ago, Walther, Inc. issued 12,000

Q126: On January 1, 2013, Robertson Company created

Q127: .....

Q128: Below is the partial trial balance for

Q138: Baltimore Bike had outstanding 12,000 shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents