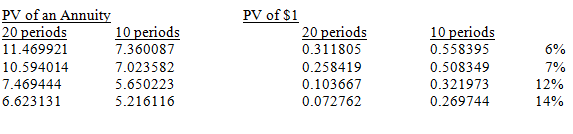

On May 1, 2014, a $300,000, ten-year, 14% bond was sold to yield 12% plus accrued interest. The bond was dated January 1, 2014, and interest is paid each January 1 and July 1. Present value data follow:

Required:

a.Compute the amount of cash received from the sale of the bond.

b.Prepare the journal entry to record the sale.

c.When preparing the journal entry, you recorded a premium or discount. Discuss why.

Correct Answer:

Verified

Q111: The creditor of a restructured loan calculates

Q125: The bonds outstanding method of amortizing a

Q136: Grandee Company sells $200,000 of 13% bonds

Q138: Match each of the following bond classifications

Q139: Briggs Industries, Inc. issued $900,000 of 8%

Q141: How is the issue price for a

Q142: Sand Castle Co. borrowed $40,000 by issuing

Q143: What are some advantages and disadvantages of

Q144: Huxby Corporation issued $600,000 of 13% bonds

Q145: On January 1, 2014, Cooper Corporation issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents