The following events relate to Mathers Corporation's issue of convertible debentures:

•On January 1, 2012, the Mathers Corporation issued $500,000 of 12% convertible bonds for $460,000. The bonds are due on January 1, 2022, and interest is paid on July 1 and January 1. Each $1,000 bond is convertible into 30 shares of common stock with a par value of $1 per share. On the date of bond issuance, a share of common stock was selling at $24.

•On January 2, 2014, 12% convertible bonds with a face value of $300,000 were converted into common stock. The market value of the common stock on the date of conversion was $40 per share. Mathers uses the straight-line method to amortize premiums and discounts.

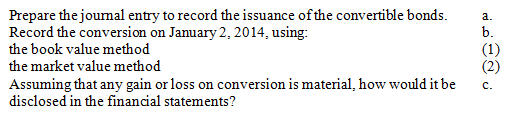

Required:

Correct Answer:

Verified

Q146: On January 1, 2014, Darth Corp. issued

Q147: On January 1, 2014, the Rangler Company

Q148: .......

Q149: On January 1, 2014, the Porter Corporation

Q150: What is the difference between the stated

Q152: List the different characteristics of bonds.

Q153: Orange Mfg. Co. issued a four-year non-interest-bearing

Q154: Durham, Inc. issued $500,000 of its ten-year

Q155: On January 1, 2014, Farmer issued $80,000

Q179: Cat's Eye, Inc. owes Brusters, Inc. $45,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents