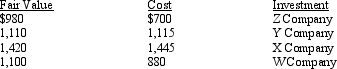

Bark Corporation began operations on January 1, 2014. At December 31, 2014, Bark appropriately had a credit balance in Allowance for Change in Fair Value of Investments of $330. No transactions related to these investments occurred during 2015, and the cost and market values on December 31, 2015, are as follows:  In the December 31, 2015 adjusting entry, there will be a

In the December 31, 2015 adjusting entry, there will be a

A) credit of $140 to Unrealized Holding Gain/Loss-Available for Sale Securities

B) debit of $800 to Unrealized Holding Gain/Loss-Available for Sale Securities

C) debit of $140 to Allowance for Change in Fair Value of Investments

D) debit of $800 to Allowance for Change in Fair Value of Investments

Correct Answer:

Verified

Q1: The generally accepted accounting principles for trading

Q10: Which of the following regarding available-for-sale securities

Q19: Dividends that are declared at year-end but

Q32: A realized gain or loss on the

Q43: Unrealized holding gains and losses occur because

Q47: In its first year of operations, Roger

Q56: All of the following statements regarding available-for-sale

Q57: The carrying value of available-for-sale debt and

Q59: Chang Company purchased several investments in December

Q60: Chapin Company purchased investments in 2017 at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents