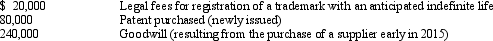

The Mario Company was organized at the end of 2014. The following items acquired on January 1, 2015, were listed by the company as intangible assets at the end of 2015:

At the beginning of 2015, Mario also purchased a research building at a cost of $275,000. The company estimates that the building will be used in numerous projects over a 20-year period. During the year, Mario spent $75,000 on research and development materials and salaries. In early January 2015, Mario purchased a patent for $75,000 that was used exclusively for a single research project conducted during 2015. Mario uses straight-line amortization over the maximum allowable periods. In addition, on July 1, 2015, Mario incurred legal fees of $25,400 to defend the new patent that had been acquired for $80,000. Mario's lawyers were successful in the defense of the patent.

Required:

Determine the amortization expense for intangibles for 2015. Mario calculates amortization expense to the nearest month.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: The Family company was expanding as a

Q90: The Ripkin Corporation was organized and began

Q93: During 2014, Quartz, Inc. developed a new

Q97: Ship Publishing signed a contract with an

Q104: What factors should a company consider when

Q122: Provide two examples of internally developed goodwill

Q123: List 3 activities that can be included

Q127: For intangible assets that are amortized what

Q128: What are the five basic categories that

Q136: What are the two methods that a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents