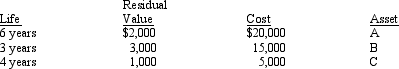

On January 1, 2014, Mullhausen Co. began using the composite depreciation method. There were three machines to consider, as follows:

At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

A) $1,200 debit to Gain on Sale of Machine

B) $6,800 debit to Accumulated Depreciation

C) $6,800 debit to Loss on Sale of Machine

D) $8,000 debit to Accumulated Depreciation

Correct Answer:

Verified

Q30: Which one of the following statements is

Q33: When low-cost depreciable assets with similar characteristics,

Q35: Which one of the following statements is

Q36: What effect does depreciation have on the

Q37: What type of cost allocation must a

Q41: The Cardwell Company purchased a machine on

Q43: Willis Limo Service purchased three used assets

Q44: On January 1, 2014, Flo, Inc. purchased

Q50: On January 1, 2013, Morgantown Co.

Q58: Which one of the following statements about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents