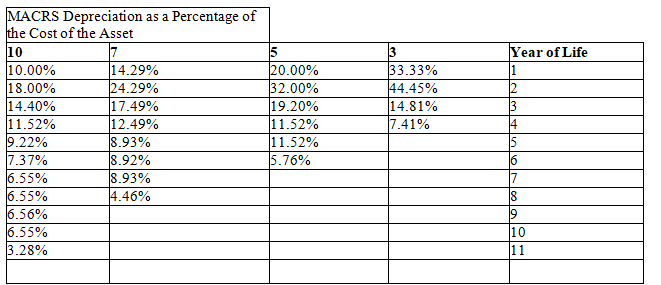

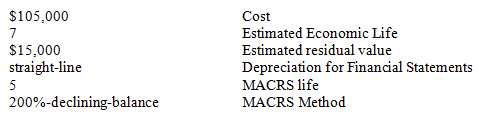

Exhibit 11-05 Wilson is preparing his tax returns using the MACRS convention. The following information relates to the purchase of an asset on January 1, 2013.

-Refer to Exhibit 11-05, what amount of depreciation would have been recorded in Wilson's books for year 3?

A) $18,000

B) $12,857

C) $20,160

D) $15,000

Correct Answer:

Verified

Q102: On January 1, 2014, Bauer Co. had

Q103: On January 1, 2013, the Wintergreen Co.

Q104: Consider the following:

a.Regent Corp. bought a machine

Q105: On January 1, 2014, Paradise Hotels and

Q106: ....

Q108: Peanut Company purchased a machine on January

Q109: The Jefferson Co. purchased a machine on

Q110: Information for heterogeneous assets A, B, and

Q111: Javlin Farms purchased three new tractors for

Q112: The Roberto Company purchased a limo for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents