Green Vegetable Mfg. Co. purchased equipment on January 1, 2014, at a cost of $800,000. The equipment is expected to have a service life of ten years, or 40,000 hours, and a residual value of $70,000. During 2014, the equipment was operated for 5,000 hours, and during 2015, it was operated for 7,000 hours.

Required:

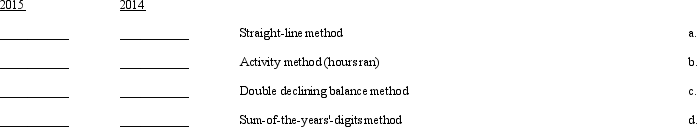

Determine the depreciation expense (to the nearest whole dollar) for this machine in 2014 and 2015 under each of the following depreciation methods:

Correct Answer:

Verified

Q108: Peanut Company purchased a machine on January

Q109: The Jefferson Co. purchased a machine on

Q110: Information for heterogeneous assets A, B, and

Q111: Javlin Farms purchased three new tractors for

Q112: The Roberto Company purchased a limo for

Q114: The following are a list of terms:

Q115: On January 2, 2014, China Co. bought

Q116: Exhibit 11-05 Wilson is preparing his tax

Q117: On January 1, 2014, Check Co. bought

Q118: Consider the following:

a.Peters Co. bought a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents