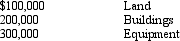

The Jacob Corporation acquired land, buildings, and equipment from a bankrupt company at a lump-sum price of $500,000. At the time of acquisition, Jacob paid $20,000 to have the assets appraised. The appraisal disclosed the following values:

What costs should be assigned to the buildings?

A) $166,667

B) $173,333

C) $200,000

D) $260,000

Correct Answer:

Verified

Q15: According to GAAP, interest must be capitalized

Q25: Early in 2014, Samos, Inc. purchased certain

Q27: Roberts Corporation purchased some equipment by issuing

Q28: On February 1, 2014, Rumor Corporation purchased

Q30: The Roger's Company incurred the following costs

Q31: On August 28, 2014, Saturn Drilling Services

Q32: On April 1, 2014, Bennett Corporation purchased

Q33: Laramy purchases a new machine by issuing

Q34: During 2014, Garnet Corporation purchased three pieces

Q69: Under IFRS, which of the following must

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents