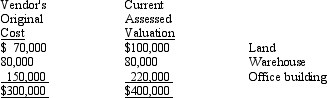

On May 7, 2014, Shane Corporation purchased for $450,000 a tract of land on which was located a warehouse and an office building. The following data were collected concerning the property:

What are the appropriate amounts that Shane should record for the land, warehouse, and office building, respectively?

A) land, $ 70,000; warehouse, $80,000; office building, $150,000

B) land, $100,000; warehouse, $80,000; office building, $220,000

C) land, $100,000; warehouse, $80,000; office building, $270,000

D) land, $112,500; warehouse, $90,000; office building, $247,500

Correct Answer:

Verified

Q27: When exchanging nonmonetary assets

A)boot must be associated

Q35: Bob's Excavating purchased some equipment by issuing

Q36: Morris recently purchased a building and the

Q37: Ramirez Company made the following payments related

Q38: A plant site donated by a city

Q42: Maxa Marina exchanged a boat with a

Q43: On May 15, 2015, January Company acquired

Q45: Exhibit 10-1 Two construction companies, Dakota and

Q50: Which of the following costs incurred subsequent

Q63: A major difference between IFRS and GAAP

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents