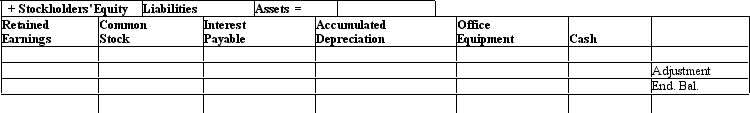

Identify the type of adjustment necessary (the type of item involved) and record the transaction for the event. Make sure to include the ending balances after adjustment.

On June 1, Tasty Sausage Corp. borrowed $25,000 from the bank by signing a promissory note from the bank, with 8% interest. The note is due in three months. Interest for June has been incurred but not yet recorded. The interest to accrue for June is $175. The June 30 adjustment is:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Depreciation on factory equipment would be reported

Q93: The accrual basis of accounting recognizes:

A) revenues

Q97: Which transaction would be recorded in a

Q98: Accounts receivable arising from trade transactions amounted

Q102: Gaston Corporation's accumulated depreciation increased by $10,000,

Q103: Refer to Coke's Statement of Cash Flows.

Q104: River Corporation's accumulated depreciation increased by $12,000,

Q105: Identify the type of adjustment necessary (the

Q106: Identify the type of adjustment necessary (the

Q111: Describe deferrals and accruals.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents