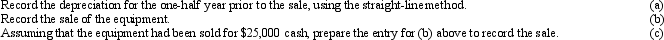

Computer equipment (office equipment) purchased 6 1/2 years ago for $170,000, with an estimated life of 8 years and a residual value of $10,000, is now sold for $60,000 cash. (Appropriate entries for depreciation had been made for the first six years of use.) Journalize the following entries:

Correct Answer:

Verified

Q150: Golden Sales has bought $135,000 in fixed

Q162: Macon Co. acquired drilling rights for $7,500,000.

Q163: On July 1st, Hartford Construction purchases a

Q165: A copy machine acquired with a cost

Q166: On July 1, 2010, Howard Co. acquired

Q168: Machinery acquired at a cost of $80,000

Q170: Clanton Company engaged in the following transactions

Q171: On July 1st, Harding Construction purchases a

Q172: Equipment acquired at a cost of $126,000

Q174: A copy machine acquired on March 1,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents